With Cloud Banking your Business will gain an Advantage

It’s called the Future

Cloud Banking will reshape the future of financial services. It will reduce IT costs, increase speed of transactions and allow for quicker adoption of innovation. Ultimately, cloud banking will allow financial companies to service their customers in a more customized, personal and timely way. That level of service can only lead to one thing: a clear advantage for your bank.

The world’s largest banks are saving 15 billion dollars from cloud adoption, cutting technology infrastructure costs by

25%

Banks can experience a 40% ainstant reduction in TCO by moving to cloud and opting for an end-to-end managed service.

Benefits At Glance – Here are some of the benefits of embracing our Cloud Banking solution

With our customized, advanced managed services, you’ll see value-driven impact immediately.

We make doing business with us simple with a single SLA (up to App layer).

You reap the benefits a dedicated Banking Centre of Excellence (CoE). On call 24/7.

You get the highest levels of support with over 2000 cloud experts and over 1050 public cloud certified professionals.

Cloud Banking gives your business unprecedented agility, scalability and the foundation for rapid innovation.

In the past, implementing infrastructure modernization, app modernization or data modernization across your ecosystem was a worrying task to take on. In most cases, those efforts would run into all sorts of hurdles resulting in backlogs and compromises.

But that’s not the case today.

Cloud Engine helps banks of all sizes deliver innovative cloud-based solutions – which can accelerate your enterprise business transformation. By leveraging cutting-edge technology, we help your organization become more agile and customer-focused.

As consumer expectations shift in this quickly evolving environment, especially in light of the pandemic and the change in habits it has caused, creating a robust digital ecosystem has become, for many financial institutions, a top priority.

Find out how Cloud Engine – a true pioneer in cloud banking – can deliver tangible value for your bank with digital transformation and application focused managed services.

In fact, Deloitte conducted a survey with IT decision-makers (which included managing directors, C-Suite executives, chief information officers and chief executive officers).

It revealed these startling statistics in the banking industry:

40% expected an increase in investment on automation

Is your bank still weighing up the pros and cons of moving to the cloud?

Here are some ‘use cases’ to help your key stakeholders make a decision.

Even though the future is driven by cloud computing, many banks are still going through the process of evaluating the ups and downs of such a move.

We’re here to help. We have a rich repository of relevant use cases to help give you the ammunition you need to get your digital transformation plans moving along. Cloud Engine has an established banking practice that comprises multiple domain experts with unmatched experience in cloud solutions.

In its journey towards digital transformation, your bank faces many challenges.

Cloud Engine helps you overcome them.

Whether you need to reduce time to market, take a branch live, launch new products or put in place a customer relationship management system, Cloud Engine has your back. Here’s what our cloud banking solutions allow you to do:

Speed To Market

Speed To Market

- Financial organizations can replicate data and application services across regions and set up new branches in months.

- Innovation comes with reduced cost of failure and increased speed. Banks can focus on creating a customized and enhanced marketplace for customers.

Shrinking Revenues & Compressing Costs

Setting up and maintaining a data center is cumbersome whereas cloud pricing is dynamic and can be controlled based on spending trends

Cloud promises maximum scalability and zero CapEx for the banking industry.

Disparate data sources, data silos, lack of single source of truth.

Better integration of bank operations is achieved through shared data

Banks can become synchronized with cloud services that enable connected data sets providing sophisticated insights and analytics

Customer expectations around a personalized, seamless omni-channel banking experience and customer support.

API-enabled ecosystems are a key to providing customers a customized experience.

Cloud technologies such as IoT, Augmented Reality and Virtual Reality, Natural Language Processing (NLP) can be leveraged on the cloud to achieve this.

Balancing innovation and regulation amid tightening compliance norms, hefty penalties and high cost-to-income ratios

Cloud’s inherent security and compliance capabilities not only come with higher standards than that of on-premise data centers, but also ensure smoother security audits in a cost-effective manner.

Increased data breach risk, security concerns and escalating cost of breaches.

Hyperscale cloud providers such as AWS, Microsoft Azure and GCP provide extreme security standards and, when implemented effectively, environments become more secure than on-premise data centers.

Waterfall development with long cycles and lack of cost control measures.

Cloud computing simplifies, speeds up and minimizes risks during the product development cycle due to capabilities such as DevOps and microservices architecture.

Value-driven impact can be realized with the introduction of advanced managed services and robotic process automation.

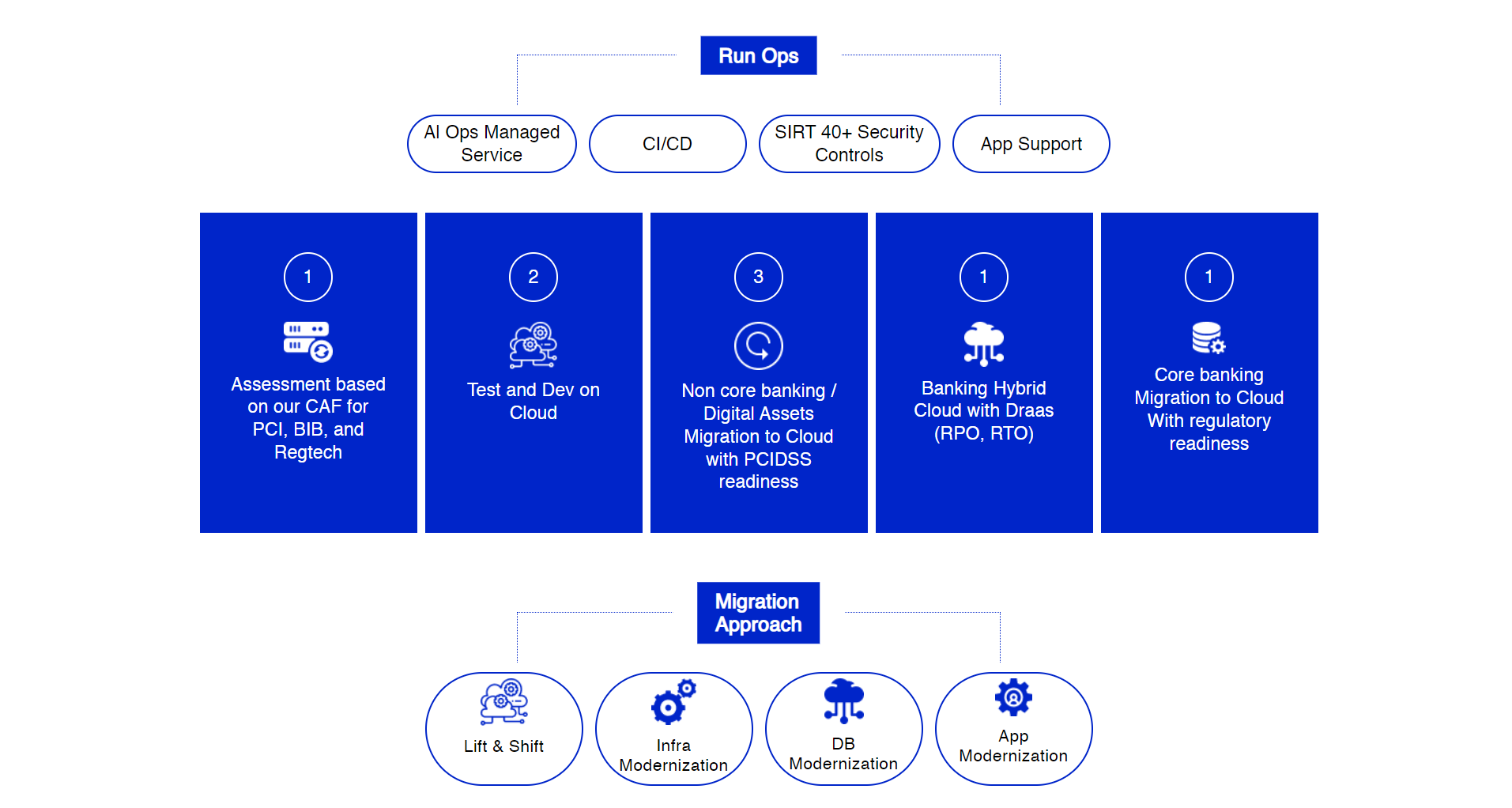

Services – How Cloud Engine makes your transition to cloud banking risk-free.

Making the move to the cloud can be a daunting task. This is why Cloud Engine has consultants who can help you with every part of the transition. We offer advanced assessment services to ensure that your path to cloud transformation is as seamless, quick, and cost-effective as possible. We help you with your infrastructure as-is analysis report, security and compliance, business continuity, business process gap analysis and mitigation plan. Our team of experts ensures the optimum solution for you at every step.

Dependency-based Assessment

Industry-leading Migration Strategy

Reference Architecture for Banking

High Performance Environment

Cloud Engin NexGen Approach to Cloud Adoption

Workload migration transforms your bank’s complete IT landscape. Migration to the cloud has to be carefully planned, designed, and executed at each stage to successfully move to the new IT infrastructure. Our global experts will help you successfully transition for greater efficiency in three areas.

- Infrastructure

- Data and application

- Cybersecuritys

Leading enterprises, like yours, are doubling their data footprints many times each year. And as such, are looking to simultaneously reduce costs, take advantage of newer forms of big data, and enjoy greater flexibility in analyzing data, with powerful AI and ML algorithms. All of these are possible by modernizing data. In other words, moving data from legacy databases to modern cloud-based databases.

- Expertise and Experience on Public Cloud platforms

- Cloud4C Migration factory enabling Data migration

- Military-grade data security for data

- Zero downtime migration methodology

- Complex and Large-scale migrations

- Three-pronged migration approach ensuring Data integrity

Your bank, if it wants to stay ahead of the curve, needs to migrate to a DevOps deployment model. This will allow for greater agility and will let you go to market faster. Cloud4C DevOps can help your bank accelerate the release process by automating testing and releasing new versions of the application code on the fly.

- DevOps for Test, Code, Vulnerability assessment and Production

- CloudOps and SysOps

- Database Management

- Security and Compliance – DevSecOps

- Backup and Replication

Banks need to keep up with ever evolving customer demands through real-time hyper personalization, instant scalability and security challenges—all of which cannot be achieved with traditional on-premise systems. Containerization is secure because applications and data are ‘contained’ within a workload and not visible unless made so—there is no ability to impact other containers. The container-based orchestration environment provided by Kubernetes offers significant flexibility in relation to building a bank’s cloud environment, whether in the public cloud, private cloud, or as a hybrid.

Kubernetes as a Service from Cloud4C helps your bank develop, run and manage cloud applications in multiple environments. Which delivers agility and reliability in an on-premise environment. Moreover, it allows for rapid deployment, updating of applications and maximizing resource utilization.

- Bank-in-a-Box

- Managed Services for Hybrid Cloud

- Compliance as a Service

- Threat & Vulnerability Management

Cloud Engine has created Bank-in-a-Box in partnership with leading core banking and digital banking application providers. This gives you a single point of accountability with SLA at application login. The cloud framework is built to align with the demanding needs of security, compliance, availability, and flexibility, enabling banks to launch their products into the market faster, as well as accelerating their digital transformation journey.

- Hosted in 25+ countries locally

- Highly secured private cloud environment

- Comprehensive security with 40+ controls with over 26+ security tools

- Compliant to sovereign laws

- Single SLA delivered at application login

- Flexible pricing model per branch, per transaction etc.

- 24*7 proactive support & monitoring

- Built-in scalability to handle traffic spikes

- Regulatory approved security stack, tailored industry-wise

Learn More

Cloud4C AIOps managed services use a combination of AI, ML, and analytics to optimize live operations management for better performance, billing, security, and availability. We ensure seamless solutions to Auto Remediation, Auto KMDB, Data Sovereignty and Fraud Detection.

- Security

- Applications

- Compliances

- CloudOps

- Backup & Replication

Cloud4C can help your bank accelerate the security and compliance process by creating a comprehensive compliance roadmap and providing you the necessary people, process, technology metrics. Some of the key compliances and standards that Cloud4C will help you adhere to are as follows:

-

- RBI Compliance

- GDPR Compliance

- IRAP

- The Monetary Authority of Singapore (MAS) Compliance

- Saudi Arabian Monetary Authority (SAMA) Compliance

- Bank Negara Malaysia Compliance

- PCI-DSS ASV Scanning

The Cloud4C Threat Detection and Vulnerability Management solution includes the continuous discovery of vulnerabilities and misconfigurations. Threats are prioritized based on the business context and ever evolving threats. The solution helps identify machine-level vulnerabilities during incident investigations.

- Automated onboarding

- Detailed machine investigation

- Single pane of glass

- Cloud-Native SIEM

- Advanced SOAR capabilities (Ex: Azure Sentinel)

Why Cloud Engine?

We have a proven track record in cloud banking

~90 Bank Customers | 5 in Top 20 Global Banks | 12 in Top 25 Banks in India

We have deployed cloud banking for some of the world’s top banks. There’s a reason for that. We are the leader in our field. We have a reputation for deep expertise and for delivering excellence.

More than that, we have a unique approach for each of our customers. That’s because in cloud banking, there is no such thing as a ‘one size fits all’ solution. Each organization is unique and has its own digital transformation strategy. Which is why we believe it is crucial to understand the current capabilities of each organization and then map them to the desired goals in a way that is right for that customer.

With this personalised approach, Cloud Engine not only shortens the go-to-market time for our clients, but empowers banks to stay in complete control through dynamic shifts in regulatory, business, and customer requirements.

Every type of bank benefits from cloud banking.

Credit Unions and Co-Op Banks

You access to bank-grade technology without associated complexities.

Established Banks

You can fast-track innovation, increase return on equity and renew customer focus.

Microfinance Institutions/NBFCs

Game Changer Banks and Banks in Emerging Markets

You enjoy faster time to market without the burden of managing complex IT systems

Cloud Banking – FAQs

What is Cloud Banking?

Cloud banking lets the financial industry to be agile, resilient and efficient by leveraging the benefits of cloud applications that legacy systems cannot provide.

At the same time, it helps optimize infrastructure costs.

Cloud service providers such as Cloud Engine offer out-of-the-box cloud environments to meet the specific needs of the BFSI sector globally.

What is a significant benefit of cloud banking?

Cloud banking enables banks to meet their priorities such as enabling technologies to provide highly relevant customer experiences, attract customers and build customer loyalty while improving business efficiencies.

The significant benefit of cloud banking is Lower TCO and operational efficiency.

A cloud environment enables rapid scalability both vertically and horizontally.

Which banks are using cloud computing?

Banking giants with a strong local and global presence, game changer banks, neo and challenger banks, microfinance institutions and credit unions, there is no limit to the number of banks that are using cloud computing.

Bank leaders keen on reducing time to market and meeting customer experience expectations are reaching out to cloud service providers for cloud environments such public cloud, private cloud and multi cloud.

Why are banks moving to the cloud?

Cloud technology has proven itself to be a cheaper, faster, and elastic alternative to on-premise data storage

Cloud solutions such as DevOps, Automation, Security, Compliance Backup and Replication have delivered true value and resulted in improvements in business efficiency.

With a strong cloud strategy, customer insights can be used to deliver better services and enable revenue generation for the banking sector.

How can my enterprise firm up its own Hyperautomation readiness?

You can help your organization get ready for process transformation by engaging with a partner such as Cloud4C that has experts and subject matter knowledge relevant to your domain. It would also help by building teams to familiarize themselves with automation and AI technologies, an area that Cloud4C is ready to assist you with.

How can I ensure a smooth transition of the newer Hyperautomation regime?

How can I ensure a smooth transition of the newer Hyperautomation regime?